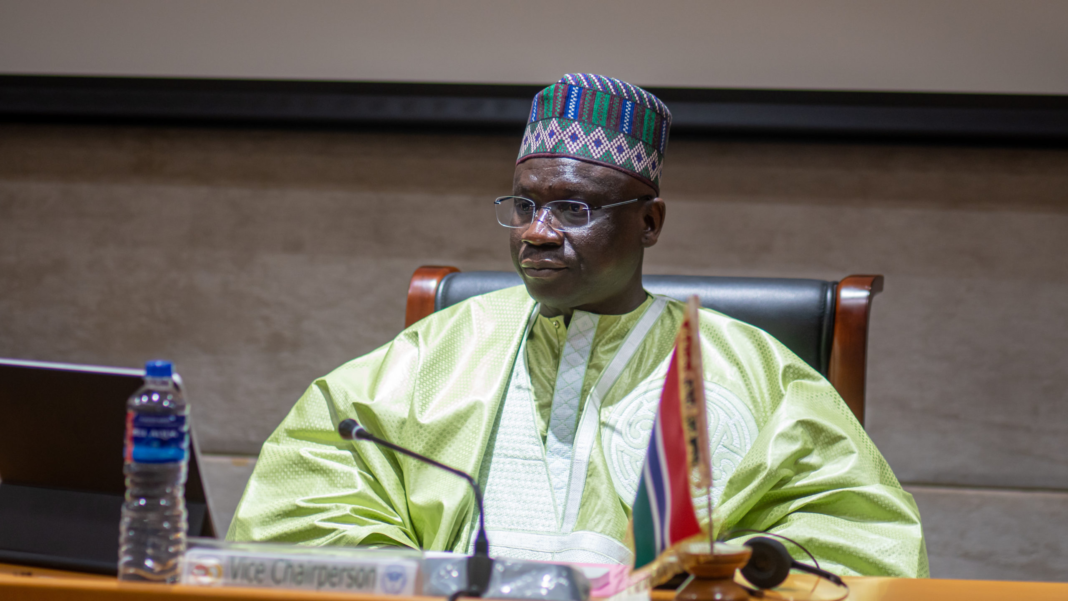

The recent revelations before the National Assembly’s Finance and Public Accounts Committee (FPAC) have reignited serious national concern over the controversial sale of Mega Bank. At the center of these concerns are the Leader of the United Democratic Party (UDP), H.E. Ousainu Darboe, and respected economists Lare Sisay and Lamin Manneh, all of whom have consistently raised red flags about the transparency, valuation, and accountability surrounding the transaction.

Their concerns are not political rhetoric. They are grounded in facts emerging

directly from official reports and testimonies.

The Governor of the Central Bank of The Gambia (CBG) confirmed that Mega Bank was sold to KM Holdings for US$15.25 million. However, prior to this sale, the Government of The Gambia had injected D650 million in public funds to clear the bank’s toxic assets, primarily non-performing loans.

This immediately raises a fundamental national question.

Was the sale of Mega Bank truly in the very best interests of The Gambia and its people?

Why was such a substantial amount of taxpayer money used to clean up the bank before its sale?

Was the sale price reflective of the bank’s actual value after public funds were used to stabilize it?

Who ultimately benefited from this arrangement?

These are not partisan questions. They are national ones.

The 2023 Auditor General’s Report flagged an outstanding balance of D24,442,558.89 linked to the sale and recommended proper disclosure with supporting evidence.

In response, the CBG Governor explained that the amount related to consultancy fees paid to DT Associates and transferred via Guaranty Trust Bank.

However, auditors informed FPAC that earlier documentation submitted by the Central Bank was unclear and incomplete, making verification difficult.

This is deeply concerning.

When public funds, especially hundreds of millions of dalasis, are involved, transparency is not optional. It is a legal and moral obligation.

Let us consider the figures:

• D650 million injected by government to clear toxic assets.

• D60 million reportedly transferred back to government.

• D20 million currently sitting in an account on behalf of government.

• Sale price of US$15.25 million.

Even accounting for partial recoveries, the financial structure of this transaction invites scrutiny. Was the valuation independently conducted? Was there a competitive bidding process? Were consultancy commissions properly procured and justified?

These are precisely the issues that Darboe, Sisay, and Manneh have warned about.

When auditors publicly state that documentation was incomplete and unclear, it signals either administrative weakness or deliberate opacity. In either case, public confidence is shaken.

The Barrow administration and the Central Bank must now provide:

• Full disclosure of the valuation methodology.

• Detailed documentation of consultancy contracts and payments.

• A transparent accounting of toxic asset recoveries.

• A clear explanation of how taxpayer funds were protected.

Without this, doubt will not disappear, it will deepen.

At the heart of this matter is not political rivalry. It is national interest.

If public funds were used to rescue a financial institution, then the disposal of that institution must clearly and demonstrably benefit the public.

So the question stands:

Was the sale of Mega Bank structured in the very best interests of the country, or was it merely expedient?

Until full transparency is provided and all audit concerns are conclusively addressed, the skepticism raised by Ousainu Darboe, Lare Sisay, and Lamin Manneh remains not only valid, but necessary in any functioning democracy.

The Gambian people deserve clarity.

They deserve accountability.

Above all, they deserve assurance that their resources are being managed in their best interest.

UDP Media and Communications Team