The assets of Gambia’s former dictator, go for a song!

April 30, 2025, Mustapha K. Darboe

Mustapha K. Darboe

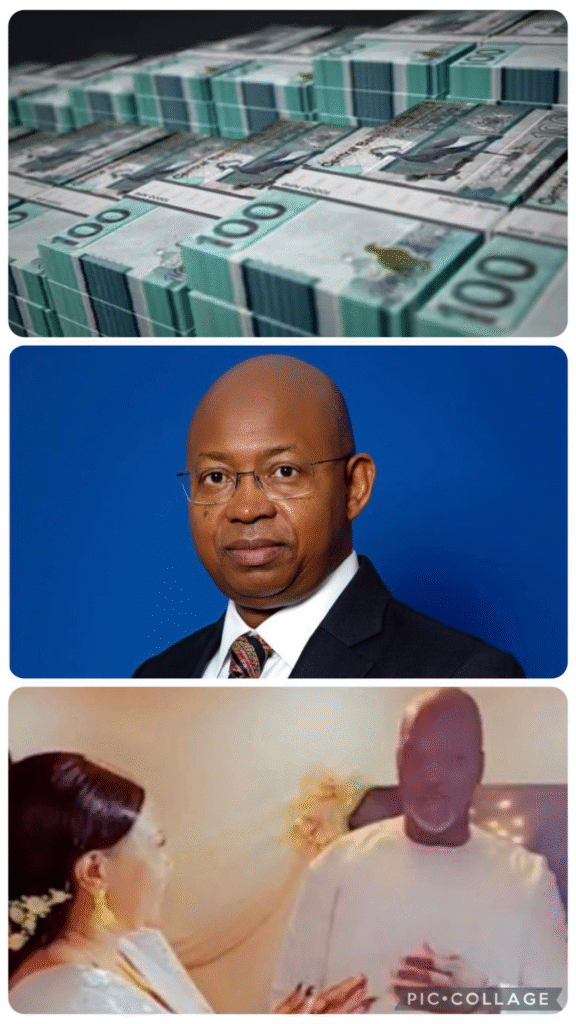

Media reports have indicated that Barry was working with a former banker, Binta Sompo Ceesay—now the wife of retired minister Tambadou—to dispose of the assets. According to its agreement with the Ministry of Justice, the firm makes 10% on all assets sold and 5% on all shares liquidated. The Janneh Commission had earlier protested a similar 10% fee being taken by court-appointed Augustus Prom, demanding a reduction to 3%.

After deducting Alpha’s share, the revenue was to be deposited into an account at the Central Bank. The state shoulders the operational cost. “All other charges for reasonable expenses, including operational costs, shall be deducted from monies generated from the transactions,” added the agreement.

The revenue reports show Alpha made at least D89, 217, 610 ($1 438, 707 as of December 2022). A recent report released by the Ministry of Justice shows that Alpha has reported D455,829,000 ($7,350,619 as of December 2022) as revenue generated from sales of assets. His agreement with the Ministry of Justice allows him to deduct his cut before depositing the money into a CBG account, which, by The Republic’s calculation, amounts to D45,582,900.

The original amount generated from the disposal of the shares and dividends received totals D765,317,774 ($12 341 381 as of December 2022) and D107,376,431 ($1 731 533 in December 2022), with Alpha’s 5% cut accumulating to D38 265, 889 and D5,368,822.

Under-declaration to tax authorities?

Alpha Barry is a Gambian chartered accountant for an international audit firm, Deloitte. The records with the Gambia Revenue Authority (GRA) show his firm, Alpha Kapital Advisory—registered on September 21, 2017—was not active until after the sale of Jammeh’s assets, as it only started paying tax from 2019 to 2022.

“As far as our records are concerned, nothing was declared in 2017 and 2018, and nothing was paid in 2017 and 2018,” said our source at GRA.

The firm declared a total of D44,379,653 as its income in 2019 and 2020 to the Gambia Revenue Authority. In 2019, the firm declared D18,022,853 and paid D2,012,077 in taxes. It declared D26,356,800 in 2020 and paid D2,202,351 in taxes. It made no declaration in 2021 and 2022 but paid D1,000,000 and D2,500,000, respectively.

This totals D7, 714, 428 in taxes to GRA from 2019 to 2022. The firm made no declaration in 2021 and 2022, but The Republic’s calculation of his shares in the sales shows he has made at least D89,217,610 from the sale of assets and shares.

According to the tax laws, the GRA charges the highest of either 1% of total earnings or 27% of profit. Without filing returns or audited accounts, which Alpha Kapital failed to do until February 2025 for the fiscal years 2021 and 2022, the tax office — according to a source who does not want to be named — cannot correctly calculate his tax liabilities.

“… If one fails to file a tax return, the person can only be assessed based on Best of Judgment, which is an estimated assessment,” said a source at GRA. We contacted Alpha Barry for comment, but he declined, accusing The Republic of biased reporting. “You have already reached your conclusions. Go ahead and write what you want to write,” he said over the phone after he was asked if he had seen the email sent to him.

Your support means the world to us! Please follow our page to keep up with our latest posts, and don’t forget to hit that like button and share our content with your friends.

Thank you for being a part of the OPEN GAMBIA PLATFORM community. Mustapha K. Darboe contributed to the article published in the theRepublic.gm Investigation Journal on April 30, 2025! Views expressed by contributors are strictly personal and not of TheOpenGambiaPlatform!

You can now write for the Open Gambia Platform, share information anonymously, and join the community. Please share your stories!

“This story was supported by Code for Africa and funded by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ).”